M&A in the Trust and Fiduciary market

Key Takeaways

Consolidation is the headline: With heightened compliance standards and jurisdictional scale providing increased appetite for inorganic market activity.

Private equity leads the way, anchoring a majority of mid-to-large end consolidators, and funding their M&A activities

Multiples are split: With large, multi-jurisdictional players and regional, partner-led practices commanding vastly different multiples.

Market overview

The Trust and Fiduciary market is a highly fragmented and differentiated market centred around three core business models. These structures form the foundations of the sector and describe the main client groups that Trust and Fiduciary businesses deal with, namely: Private Clients, Corporate Clients, and Fund Clients.

Valuation trends often correlate with service complexity, multi-jurisdictional coverage, and revenue quality. While outcomes vary by client, single-jurisdiction private clients generally have simpler needs and require less complex offerings, which in turn command lower fees.

By contrast, corporate and fund clients seeking multi-jurisdictional services require more comprehensive service offerings, leading to higher fee rates, and a business that supports a greater valuation.

Private equity firms, given the average life span of a specific fund being around 10 years, become clients of a trust for the life of the fund or more, generating consistent and predictable revenues in return for low-value work that can often be outsourced to low-cost jurisdictions. Therefore, when evaluating Trust and Fiduciary firms, buyers assess not only growth but also client mix, cash-flow durability, and margin quality.

On the other hand, private clients mainly require trusts to set up a new company, handle simple asset protection and governance, and potential high-asset-value trust administration.

Across a series of mandates delivered at Dyer Baade, advising both buy-side and sell-side, we see a handful of key variables that influence M&A activity in the Trust & Fiduciary sector.

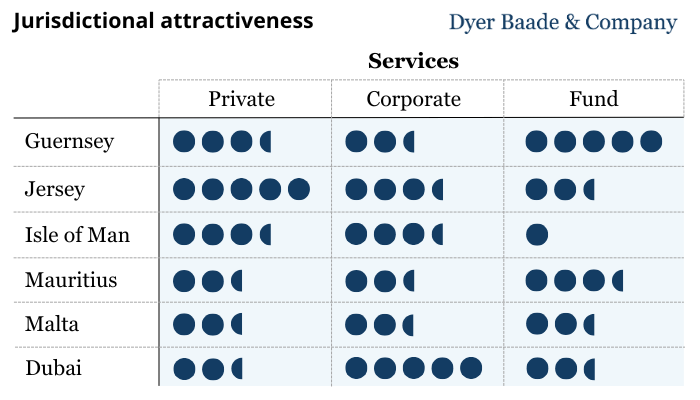

Jurisdictional attractiveness

Jurisdiction is one of the strongest determinants of commercial success and valuation in Trust and Fiduciary businesses. When evaluating the attractiveness of a specific jurisdiction, it is important to understand how its legal system, regulators, and banking sector work together by analysing a series of qualities such as reliable courts and stable laws, international treaties, and cross-border banking activity.

Private clients look for discretion within disclosure regimes, efficient probate processes, and seasoned advisers.

Corporates seek fast, streamlined incorporations, transparent processes, and clear accountability.

Funds gravitate toward domiciles with strong regulatory frameworks and robust infrastructure that minimise operational friction.

Illustrative ratings of jurisdictional attractiveness

Source: Dyer Baade & Company (2025)

As shown in the chart above, Guernsey offers a robust, administrator-friendly regime experienced in corporate work, with a market-leading record in fund-level and private equity structuring. Operating costs are often lower than Jersey, while professional expertise remains high, making it a suitable choice for EMEA multi-jurisdictional mandates.

Jersey is a mature market leader with regulatory credibility, straightforward banking access, and a deep services market.

The Isle of Man delivers efficient corporate structuring at competitive costs. It is often perceived as less comprehensive than the Channel Islands and lags in fund service offerings, but it remains compelling for less complex corporate platforms and single-jurisdiction private clients.

Mauritius serves as a routing and domicile hub for African and Middle Eastern clients, as well as a lower-cost operational base for larger groups.

Malta has gained traction recently as a lower-cost EU option, with a growing pool of providers. Despite periods of scrutiny, it has become competitive in the e-gaming and adjacent digital corporates, providing value as a specialist locale.

Dubai is a well-regulated, tax-efficient hub offering high-quality fiduciary and corporate services, ideal for Middle Eastern and multi-jurisdictional clients, though operating costs are generally higher than traditional offshore centers.

In practice, private clients favour familiar jurisdictions; corporates, in particular, weigh Jersey & Guernsey for governance and speed. Funds concentrate where ecosystems are deepest, i.e., the Channel Islands for EMEA and Mauritius for foreign investment in Africa and India.

Additionally, growing hubs, such as Dubai and Singapore, are gaining market presence and traction as stable, attractive tax regimes with growth potential.

In mid-market Trust and Fiduciary M&A, a business’s jurisdictional footprint can be a material value driver - affecting the buyer pool, deal certainty, revenue quality, and ultimately the price a buyer is willing to pay.

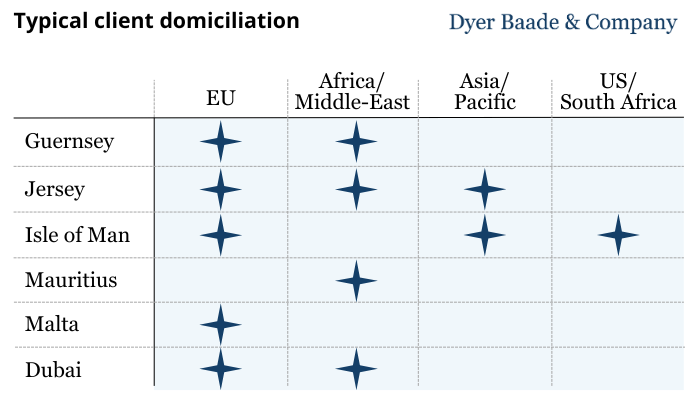

Client domiciliation

Each jurisdiction carries distinct regulatory, tax, and Anti-Money-Laundering (AML) requirements, which directly influence compliance complexity, operational costs, and perceived risk within a Trust or Fiduciary business.

Typical Trust & Fiduciary client domiciliation

Source: Dyer Baade & Company (2025)

At Dyer Baade, we are seeing that buyers are scrutinising domiciliation profiles more closely than ever: firms with well-documented, transparent cross-jurisdiction client bases are leading with higher valuations—as is the case of JTC’s acquisition of Citi Trust, which manages over $70 billion for 2,000+ UHNW clients across seven trust jurisdictions—on the other hand, firms with high-risk or poorly documented client domiciles face longer due diligence, higher risk adjustments, and, in some cases, reduced buyer appetite.

Regulatory trends in the market

Regulatory requirements are tightening, and supervisory practice has shifted towards assessing the effectiveness of current controls in operation. The 2025 EU AML package, together with the establishment of the EU Anti-Money Laundering Authority, moves member states (such as Malta) toward a more harmonised set of rules and standardised beneficial ownership oversight.

For administrators, this translates into higher verification standards, increased event-driven reporting obligations, and greater accountability for data accuracy. Banks have also raised onboarding thresholds, with expanded sanctions screening and more detailed source-of-wealth & funds documentation, which lengthen file preparation and approval timelines.

Operational expectations are increasing as DORA (Digital Operational Resilience Act) introduces explicit guidelines on ICT risk management, incident reporting, and third-party oversight, with NIS2 expanding baseline cybersecurity controls. Even where trust and fiduciary entities are not directly involved, these requirements frequently become incorporated into client and banking contracts and other documents, resulting in increased compliance costs.

For fund-related mandates, AIFMD II introduces additional reporting on delegation, enhanced liquidity management expectations, and a clearer framework for valuation control. The combination of these factors results in higher fixed compliance costs, more extensive documentation, and a premium on standardised processes that can produce audit-level evidence across multiple jurisdictions and varying levels of reporting requirements.

Given the recent increase in regulation, demonstrating fully documented operational resilience is more critical than ever. Our expertise in this sector is key to unlocking value from a sale-readiness perspective, with Dyer Baade Chairman Stuart Dyer bringing significant experience as former Head of UK Distribution and Executive Chairman for Fiduciary Services at Close Brothers.

Private equity participation

In recent times, we see private equity has emerged as a strong source of growth capital for Trust and Fiduciary businesses. A decade ago, sponsor ownership was rare and concentrated on a handful of platforms; today, there are a significant number of mid-to-larger operators across the major fiduciary hubs backed by private equity. Names that now sit within private equity portfolios include IQ-EQ, Ocorian, TMF, Vistra/Tricor, Alter Domus, Suntera, Hawksford, Equiom, Summit, and ZEDRA, alongside others. Alter Domus being a notable example, receiving PE investment from Permira in 2017—fuelling growth through international expansion—before a more recent deal reduced Permira’s stake, with another PE firm, Cinven, acquiring a majority share in March 2024.

Further recent activity has reinforced this shift. Permira’s recommended take-private of JTC in November 2025 for a reported £2.7 billion is the headline signal that scale fund administration platforms remain prime PE targets.

In the mid-market, the Sovereign-backed Summit Group has continued to execute a buy-and-build strategy, most recently acquiring R&H Jersey in July 2025 to deepen its Channel Islands footprint. Inflexion-backed Ocorian has also been active, acquiring the US fund administration firm E78 in August 2025 to expand its footprint and capacity in the US.

Alongside these transactions, sponsor recapitalisations and selective carve-outs of corporate fiduciary units continue to recycle assets into specialist owners, while private credit has become a routine financing route for both platform acquisitions and subsequent bolt-ons.

The effect is a market increasingly anchored by private equity-owned, multi-hub platforms that operate to institutional standards and continue to consolidate the fragmented market. Understanding which consolidators are actively searching for potential acquisitions, and why, is vital when considering a potential exit in the Trust & Fiduciary sector.

Sources of value creation

In terms of valuations, the market maintains a drastically varied range. Our proprietary research at Dyer Baade shows that at the top end, scaled, fund-facing platforms with multi-jurisdictional coverage and institutional-grade processes can command EBITDA multiples of up to 26.2x. This premium reflects market share, revenue quality, service offering capabilities, and multi-jurisdictional capacity.

At the same time, the sector remains highly fragmented. A majority of targets are small, partner-led firms spun out of local accountancy or law practices. Larger, more established platforms can acquire these bolt-ons at relatively modest entry multiples, meaning successful integration can result in higher margins under a stronger brand and multiple arbitrage as earnings are re-rated inside the wider group.

Conclusion

The centre of gravity in Trust and Fiduciary market has shifted toward scaled, multi-jurisdiction platforms operating to institutional standards, pulled by regulation, enabled by PE capital, and accelerated by bolt-ons. For owners, strategic choices are clear: deepen capabilities, broaden jurisdictional reach, and professionalise compliance and regulatory controls, or crystallise value through joining a larger player.

At Dyer Baade, we possess a wealth of experience advising both buy-side and sell-side clients, giving us a comprehensive view of the market. A notable recent sell-side example is our role as lead adviser to Sandshore, a UAE-based corporate and family office services provider, in its 2024 sale to Praxis, a wealth and corporate services provider.

If you’re a CEO, entrepreneur, or investor in a leading privately owned business and want to explore how to unlock greater value, book a free and confidential strategic assessment with our team.