M&A in the UK Wealth Management sector is booming

Key Takeaways

Unprecedented growth in M&A activity within UK Wealth Management, driven by an influx of private equity capital and consolidation strategies.

Significant potential for EBITDA multiple arbitrage, with possible gains exceeding 130% in some cases.

Surge in valuations, with prices for acquisition targets increasing by up to 70%, presenting challenges for value creation through M&A.

Intensified competition in the market, with 31 active private equity-backed consolidators and regional firms also pursuing acquisition-led growth strategies.

2021 was a remarkable year for the industry. We saw an unprecedented influx of new private equity capital into the industry, increasing the number of private equity-backed consolidators to 31.

At the heart of most private equity strategies is EBITDA multiple arbitrage: Buy a number of smaller businesses, consolidate them into one larger firm and benefit from the valuation premiums given to larger businesses. Our research shows that the potential for EBITDA multiple arbitrage is substantial and could exceed 130% in some cases.

It is therefore no surprise that in addition to the private equity-backed consolidators a significant number of regional and privately owned firms have also started to raise financing to compete with the larger firms for acquisition targets with the aim to grow through M&A. Whilst the long-term macro trends are very supportive for the industry, our data shows that prices for small, medium and large acquisition targets have started to increase by up to 70%. Such an increase in prices makes it much harder to create value through M&A, particularly if buyers are pricing execution risks correctly.

The favourable environment triggered a wave of new private equity investments

Historically only one or two private equity firms entered the UK wealth management industry per year. This all changed in 2019 when 5 firms entered the market and culminated in the financing of 16 new PE-backed consolidators in 2021.

Almost all PE-backed strategies are based on consolidation of smaller firms or in other words buy-and-build. With 22 (71%) of PE-backed firms being at the beginning of their investment cycle in 2021 it doesn’t come as a big surprise that deal activity and, as a consequence, valuations skyrocketed.

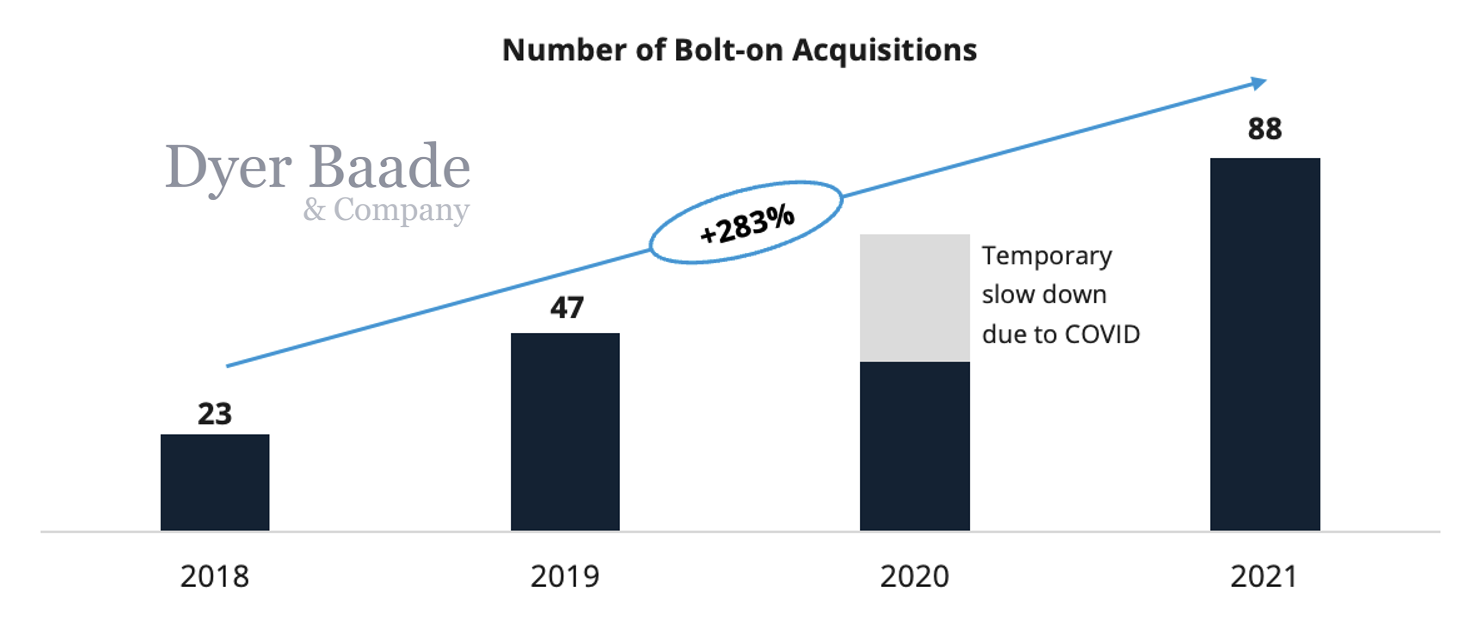

Our proprietary data shows that the number of bolt-on acquisitions has almost quadrupled in this four-year period, reaching 88 in 2021. With 31 private equity firms being active, it means that each PE-backed consolidator bought on average 3 bolt-on businesses during that year. Whilst this number is at the upper end of the expectations, it should be noted that the number of underlying acquisitions is likely to be higher, as some smaller book deals (typically books of circa 50-100 clients from retiring financial advisers) are sometimes not reported and therefore pass below the radar. These smaller book deals are relatively common, but PE-backed consolidators tend to ignore them as they are usually too small to move the needle. The statistics above only include deals above approximately £500k EBITDA.

The significant shift in demand has also increased valuations. Comparing deals before 2019 with deals up to and including 2021 shows that valuations have gone up by 17%. Whilst the median price for bolt-on acquisitions was around 7.8x EBITDA between 2016-2019, similar transactions were valued at 9.1x EBITDA in 2020-2021.

These fundamental changes with regard to valuations make it harder for private equity firms or other consolidators to create value. While value creation is still possible (please contact us for our white paper on value creation through M&A), most acquirers are facing another key challenge in the first place: finding the right acquisition targets. Identifying and acquiring businesses off-market has become a real challenge as most sellers are approached by brokers and PE-backed acquirers on an almost daily basis. High-quality businesses (particularly if they are of a decent size) are almost always sold via an auction process and winning these processes is hard without deep knowledge of the targets and the sector.

If you’re a CEO, Entrepreneur, or Investor in a leading privately owned business and want to explore how to unlock greater value, book a free and confidential strategic assessment with our team.